AboutUnknown Facts About Driving & Transportation - Guides To Services - State Of ...

Who needs new chauffeur insurance? If you're entirely brand-new to driving or haven't been behind the wheel in a while, car insurers will charge you greater rates for a policy.

Make sure to inspect with regional and local cars and truck insurance coverage companies in your area. Remember that getting on a car insurance policy with a moms and dad or partner may reduce your premium significantly.

com LLC makes no representations or service warranties of any kind, express or implied, as to the operation of this site or to the information, content, products, or products consisted of on this website. You specifically agree that your usage of this website is at your sole risk.

Getting The How To Get Cheap Car Insurance For Young Drivers To Work

We initially looked at this back in 2018, when we exposed 21 days ahead was the cheapest time to get vehicle insurance coverage quotes. We have actually now done this research study for the 3rd time, and it's exposed that the least expensive time to get cars and truck insurance coverage quotes is 23 days ahead of your renewal date (though at any time between 19 and 25 days ahead doesn't alter the cost by much).

Insuring a 16-year-old chauffeur can be pricey. Since teenager motorists don't have the benefit of experience for insurance provider to consider when setting rates, they are thought about riskier to insure. There are strategies you can utilize to help conserve cash and get the best vehicle insurance coverage for a 16-year-old chauffeur.

There is one area where moms and dads can score considerable cost savings: Selecting to add a 16-year-old to a family plan, which is typically less expensive, as opposed to having the teenager get a specific policy. Insuring a 16-year-old on a private policy includes an average increased expense of $1,947 per year.

Getting The Driversed.com: America's #1 Driver Education Courses Online To Work

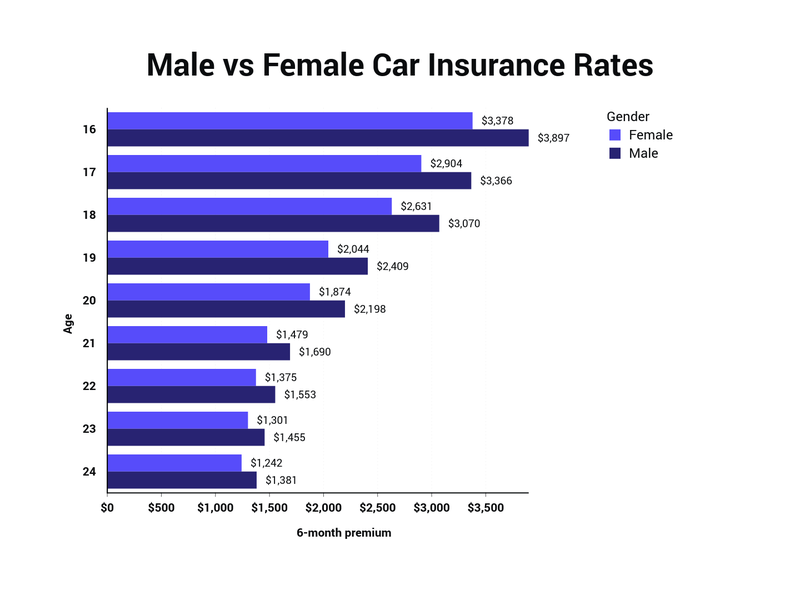

Cheapest Car Insurance Coverage for 16-Year-Old Males and Females, There is a distinction when it concerns gender for insuring brand-new teenager motorists. Normally, it costs more to insure a 16-year-old male motorist than a female motorist of the same age. That's because male drivers have a higher accident rate and more insurance coverage claims and are for that reason more of a threat to insurance provider.

Scroll for more While the least expensive typical expense we found for adding a 16-year-old to a family policy is $3,146, it costs approximately $5,318 for a specific policy for the same-age motorist. Just by adding a 16-year-old to a family policy, you can save an average of $2,172 annually.

Deciding to add one of these young drivers to a household policy is one strong option to consider, which can conserve approximately practically $500 annually, even if you opt for the most affordable alternative for either type of policy. Compare Quotes for the very best Policy for Your Household, No matter the chauffeur, when you're acquiring car insurance coverage, comparing quotes can help you save.

The smart Trick of What's The Best Car Insurance For New Drivers? - Metromile That Nobody is Discussing

The more quotes you can get, the much better. Screen Your Teenager Motorist to Make Sure a Tidy Driving Record, Just like chauffeurs of any age, ensuring your young chauffeur keeps a tidy driving record is a fantastic method to keep cars and truck insurance coverage costs down. Conversely, mishaps and tickets will considerably increase cars and truck insurance costs for your 16-year-old.

Lower the Coverage Amount, The amount of protection you need will differ, but for those who want, reducing those can reduce the cost of insurance provider. You'll still have to abide by your state's minimum requirements, of course, but reducing the protections can be a genuine alternative for those aiming to conserve.

It's also crucial to be mindful that by choosing this type of coverage, you won't be covered for your own car damage or injury costs. In case of a crash, that might become a pricey problem if you don't have money on hand to replace or fix a trashed car.

Cheap Car Insurance For New Drivers Under 21: What To Know Fundamentals Explained

Something like a Camry a four-door sedan that made the top-safety pick from the Insurance Institute for Highway Safety will be a more affordable choice to guarantee than a muscle car that concentrates on performance, like a Mustang. Sports vehicles and costly luxury vehicles, in basic, will be more pricey, too.

Traffic Statistics for 16-Year-Old Drivers, The more youthful the motorist, the more likely it is that they'll be associated with a crash. According to data for police-reported crashes in 2014 to 2015, motorists aged 1617 were associated with practically double the variety of deadly crashes than 18- and 19-year-olds for every 100 million miles driven.

Restricting the number of miles your teens drive could both aid cut expenses and keep them safe. Often, individuals are paying through the nose for policy add-ons they don't actually require.

1. Evaluation Your Coverage Policy Every 6 Months There's a lot of competition present in the insurance market, which suggests rates typically change for companies to keep up with demand and changing organization needs. Often, when you get comfy with an insurer, they'll gradually raise their rates while other business are decreasing theirs.

It's constantly a great idea to call around when your policy is up for renewal at the end of six months to ensure you're still getting the cheapest cars and truck insurance possible. 2. Check for Discount rates There are some clean tricks in the insurance market that you frequently do not hear about unless somebody clues you in.

Little Known Facts About Car Insurance Rates For New Drivers - Policygenius.

Lower the frequency of accidents on your record, and the insurance business will be happy to minimize your rates. If it identifies that you're a cautious chauffeur, details can be transmitted to the company to get you less expensive automobile insurance.

You can utilize this competitors to get better rates on your insurance. Look for Discount Coupons Think it or not, however you can in fact get vouchers for cars and truck insurance.

https://www.youtube.com/embed/GosWET3WsQg

Downsize Your Cars and truck The bigger and more costly your automobile is, the more it will cost to guarantee. If inexpensive insurance and great coverage are what you look for, you'll have a really tough time discovering that with a large automobile.