AboutThe smart Trick of What Happens If You Get Into A Car Accident Without ... That Nobody is Discu

Routh, when you both came to see us in our home, in which we saw your empathy and consideration at that time. - Linda "I would like to leave a testimonial thanking Steven and Allison for their care and understanding.

Thanks to Martin & Jones for looking after Mike's care because his injury in 2005. You have actually been there for Mike and his family for a long time.

7 Easy Facts About 5 Tricks To Get Your Car Fixed After A Crash - Mcmullin Injury ... Described

I hear nothing however dreadful stories of dealing with attorneys and their workplaces, however I have actually had nothing but favorable experience. You have lots of special methods of working with people in need of help.

I want you all the very best." - Mary.

Top Guidelines Of Can I Get Insurance After An Accident? (2021) - Motor1.com

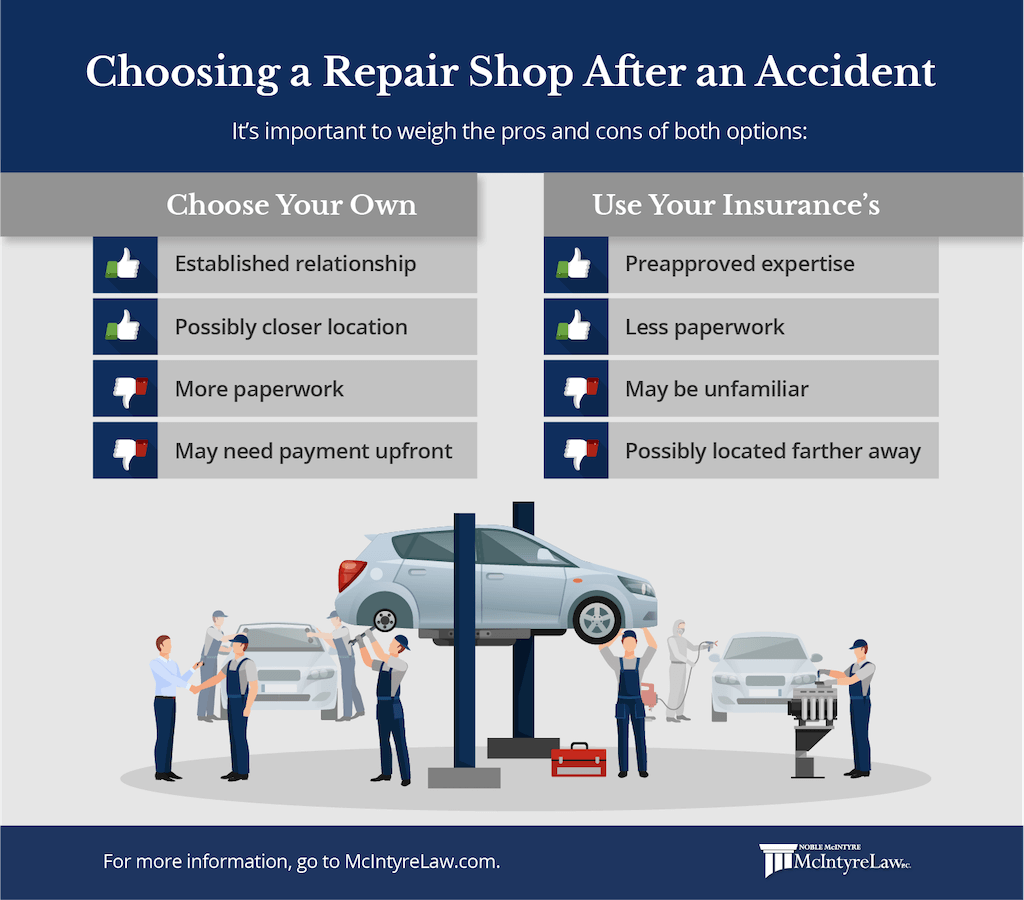

There are lots of things you require to think about prior to you decide. In this post, we'll assist you comprehend the pros and cons of each option so you can make the ideal option with confidence. What should you think about when paying out of pocket or sending a claim? When you get into a mishap and your vehicle is harmed, there are a few things you require to think about before filing an insurance claim.

Here are three things you must think of. The number of individuals are associated with the mishap, and who's at fault? Consider how many people were included in the mishap and who triggered it. That will have a significant influence on whether you must file a claim. For example, if you cause a mishap with another cars and truck and both vehicles are harmed, you require to submit an insurance coverage claim.

The Only Guide to What Happens If The At-fault Party Doesn't Have Car Insurance?

If you're not at fault and your automobile sustains significant damage, the other driver's insurance coverage will spend for the damages for you. There are specific situations where you don't necessarily require to file a claim. For instance, if you hit a fixed object and you damage your bumper, you can most likely get away with spending for the repair work yourself.

For example, say you enter a mishap and your cars and truck sustains $2,000 worth of damage. If you have a $500 deductible, you will pay $500 and the insurer will provide you $1,500. There are 2 parts of your automobile insurance plan that have a deductiblecollision and comprehensive protection.

The Ultimate Guide To Diminished Value Claims Explained - Nextadvisor With Time

If your deductible is greater than the out-of-pocket repair cost, you should spend for the damages yourself. If your deductible is $500 but the cost of repairs is only $350, it doesn't make sense to seek repayment from your insurance coverage business. Because circumstance, the insurance provider could not give you any money since your deductible would in theory cover the expense alone.

However sadly, the majority of people do not have auto repair work insurance. It's not always simple to decide if you ought to pay for the damage out-of-pocket or if you ought to seek insurance cash. Prior to you decide, consider who is at-fault and just how much the repairs will cost in contrast to your deductible.

After An Accident - Minnesota.gov Fundamentals Explained

What To Do If You Totaled A Car With No Insurance coverage "I totaled my cars and truck without any collision insurance." Those are words you never desire to need to say. A vehicle accident is a low point in life. There's a possibility people have actually been injured and need medical attention. Your vehicle and potentially other automobiles might be harmed severely, and it may be permanent.

A vehicle is stated to be amounted to when the cost to fix it simply isn't practical. The calculation for totaled is different depending on who is evaluating the cars and truck. How to Offer if an Automobile is Totaled If you're dealing with an insurance agency evaluating a totaled car, they'll say the car is amounted to based upon the repair work costs.

What Happens If You Have A Car Accident Without Insurance? Fundamentals Explained

For instance, if your automobile deserves $10,000 and the expense to fix it back to the method it was surpasses its value, it's amounted to. For others, an amounted to automobile is a portion of the repair work cost. Every insurance provider has a calculation they utilize, however numerous are around 70 to 80 percent of the automobile's value.

Another kind of insurance coverage you might have that might conserve you in the case of amounting to a vehicle is GAP insurance coverage. Gap insurance coverage is really an acronym Ensured Automobile Security insurance coverage.

The smart Trick of Can You Sue Someone For Hitting Your Car Without Insurance? That Nobody is Discussing

How Does Gap Insurance Coverage Work if Your Vehicle is Amounted to? If you have automobile insurance coverage, you'll get the worth between the quantity owing to the financing business after your cars and truck's insurance settlement has actually been paid out.

And if your vehicle loan is covered by insurance entirely, or you have some cash coming back to you, space insurance pays absolutely nothing. It's still worth having GAP insurance if you have no gap insurance and your car is totaled in an insurable mishap, you may still have to pay loans on a lorry you do not owe.

Our Can I Just Keep Cash From A Car Insurance Payout And Not Fix ... PDFs

Will Space Insurance Cover A Totaled Vehicle with No Insurance coverage? Nope. You see, space insurance is just in impact IF you have accident or comprehensive insurance protection. You may wonder why, however it's because there needs to be an insurance coverage payment, otherwise there's no difference for gap insurance coverage to pay.

You're stuck with an amounted to car that you're still paying for, PLUS you've been paying gap insurance coverage and unable to utilize it. At first, it looks like a small price to pay. Space insurance has to do with 5 percent of the insurance cost for your automobile. Add it up, and it can cost substantially more than it will ever pay out to you.

The 7-Second Trick For Who Pays For Your Auto Repair After A Car Accident That Wasn ...

It's great to have if you require it. However like all insurance coverages, it makes the insurer more cash, not you. If your automobile isn't insured during the accident, the term 'amounted to' is approximate. You'll need to choose on your own if your automobile is worth fixing or not and what you must make with your amounted to automobile.

What's greatly worse is that if there were other automobiles involved in the accident, you could be taken legal action against for their repair work or medical expenditures! You may not have the cash to fix your vehicle after it's all said and done.

The 9-Second Trick For Auto Body Repair Costs: Should I Pay Out Of Pocket Or Submit ...

https://www.youtube.com/embed/CI_mFIfFarsPlus, your automobile will still have more worth than one that doesn't drive at all. When you need to get a state examination, your car most likely won't pass.